Finance & Business Centers

How we can help you grow your practice

Financial Tools and Resources

Aspen Laser provides numerous financial tools and resources designed to increase your practice profitability and return on investment (ROI) with your laser.

Finance Your Laser

NCMIC GROUP, INC

14001 University Ave.

Clive, Iowa 50325

Toll Free: (877) 770-7244

STEARNS BANK

500 13th Street PO Box 750

Albany, MN 56307

Toll Free: (800) 247-1922

Save Taxes – IRS Section 179 (Form 4562)

Create a tax break with your Aspen Laser purchase. Section 179 of the IRS tax code allows businesses to deduct the full purchase price of the Aspen Laser System, purchased or financed during the tax year in which the laser is put in to use. This means when you buy (or lease) the Aspen Laser System you may be able to deduct the entire purchase price from your gross income up to the stated IRS limitations. Consult your tax advisor for current rates and savings.

Reimbursement Programs

The Aspen Laser provides an opportunity to add a profitable cash based service to your practice.

- Patients feel the treatment and see the results often from the first treatment

- Payment is immediate for services (no delays like insurance)

- Payment in full improves profitability (no discounts like insurances)

- Operational overhead costs are reduced with less staff needed for billing

- Patients love the treatments and will refer family and friends

At this time, there are no CPT codes that specifically describe “low-level laser”, however there are codes that medical practice are using for reimbursement. Information regarding these codes and required documentation are available upon request.

Billing Code Report – CLICK HERE

Aspen Laser has identified the best financial services to offer your patients. With low monthly payment plans, any patient can afford and benefit from laser therapy. In addition, our customized laser treatment “Loyalty Card” Program will keep patients coming back for more laser treatments.

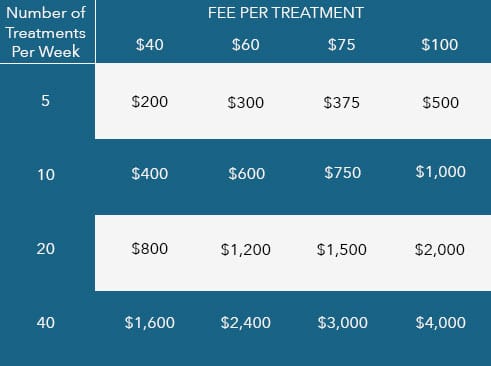

FAST ROI PAYS FOR THE LASER*

Revenue Estimation Calculator

Revenue

Still have Questions?

Didn’t get your questions answered above? Please contact one of our representatives with your request.

Laser Safety Training Program Now Available

We have partnered with Laser Safety Certification, Inc, a nationally recognized laser safety consulting company, to develop a new and

exclusive “3 in 1” Laser Safety Training and Certification Program.